New Year's Special: Structuring Value needs a Process & Practice

Recap of Live Session #2 and Prep for Session #3 Mon. 10th Jan 20:30 CET / 2:30pm ET

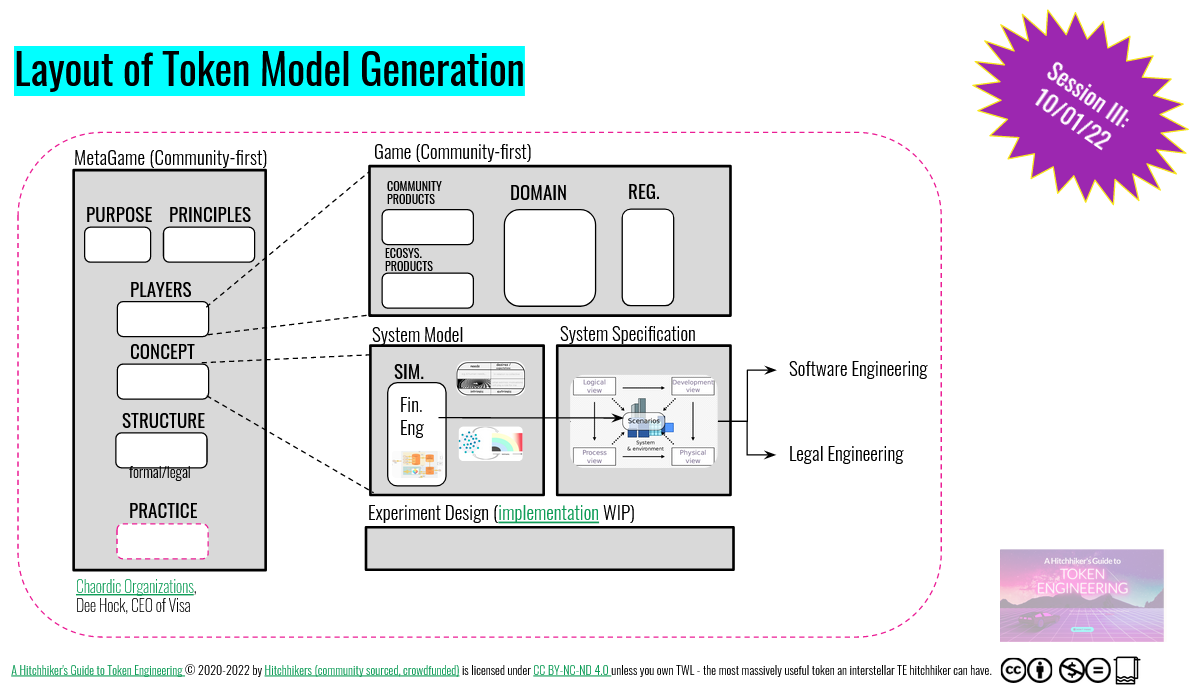

Session #2 was very ambitious: we wanted to gloss over Ecosystem Valueflows (a subsection in Chapter 4), which helps in sorting through the raw value network, crystallizing agents, value stocks. As well as actions, i.e. user and system policies, which make those values flow (or not). In the second half we wanted to make the link to identify feedback loops to sustain and grow value and network for example. And as a first for all (incl. us the authors) we would make the link between these systemic description (Chapter 4) of policies/feedback loops and the value capture and distribution mechanisms (Chapter 3).

We only made the first half, duh! Mind you though, that portion was roughly the 2.5 weeks course (which we ran three times with TE Academy) in under 2 hours. Coming closer to the dream to make this more accessible to many more Hitchhikers to Token Engineering ;)

Before we give an overview and some links to read (if you want to prep) for our Session #3: Embarking on the Everlasting Experiment - live token network, we will recap Session #2 here. Aaaand we also want to announce a second round of this experience for February! It was rewarding to see audience turn into participants in just two sessions. We also developed some ideas on how to complete the ambitious session #2!

So, we look forward to seeing you on Mon. 10th Jan. 20:30 CET / 2:30pm ET (add to calendar, call link) for Session #3!:

As you can read in the chat and browse through the recording of Session #2;

it’s much easier to talk about “value” than to actually pin it down.

The valueflow diagrams when applied properly (i.e. many iterations to get to the essence of the value network) can help you. Even in the first attempts, they are already helpful to sort through the ideas of value creation and value add:

One of the participants wanted to explore “Membership”. Good idea, a typical business model, and one we saw actually nicely implemented with NFTs and combinations. To decide how to visualize concepts in valueflow diagrams, you ask the following questions:

“Does it have rules (regulative character)?” then it is a policy

a system policy is something that needs to be defined by the “system” and enforced by the system, e.g. functions in a smart contract, features on a platform, decision making process by a group etc.

an agent policy is the set of rules that apply to their actions

“Does it accumulate through a policy?” then it is a value stock

“Does “it” feed in (source) or extract value (sink)?” then it is an “agent”

a population of agents within this community/ecosystem, which can have subpopulations with varying (sub)sets of rules but the policy would be of the same class for all

another community or ecosystem, i.e. a whole other value network with various puplations of agents etc. but mean the same interaction at the the interface to this network

or automated/external process/system that is beyond the scope, i.e. abstracted away

This is it - and the result is actually enough to see following critical questions:

what is the value that this membership will allow some agents to extract (sink)?

who are the agents that will create and feed-in that value (source)?

why would they create it if others are going to extract it?

We didn’t get to the last question, which would have led us to the second part of this exercise: feedback mechanisms that can be translated into value capture and distribution mechanisms. To finish up, we may have a 4th session after all, let’s see what participants say on Monday :)

After we laid out the first two questions, a participant pointed out the core issue: Should those answers not come from more fundamental thinking about the “vision and mission”? Yes, and that is the topic of Session #3: The Everlasting Experiment.

We hear and talk of vision and mission, as much as of value. Likewise, there is a systemic way to think and - in token economies a collaborative way - to define these.

Defining the vision and mission collectively, can have an immensely valuable community building effect. Traditionally, this has been typically the “job” of a visionary CEO, or the founders, and CSO, who analyze the advice of board members, market research, and industry leaders - because it requires deep, clear thinking.

Consensus even means “feeling together.”

So web3 communities do not reap the consensus and alignment value of this exercise, if they leave it to a leader or a core team; if they do it for marketing purposes only; if they do not repeat it everytime the network topology (new agents, new value stocks) changes substantially.

Since we do not have top down structures, we are missing a critical property that top down, command-and-control, structures have: alignment. Thus, web3 communities resort to “consent” and “fork” - and still require a charismatic leader that radiates enough to signal. Which resemble typical corporate structures, the visionary CEO, even the consent or fork is quite business-as-usual: in bigger law and consultancy firms it’s called: “up or out”. The tokenized version is different, and better, since for token holders a fork doesn’t diminish value - yet one can see how it isn’t a step change to eliminating coordination waste.

Also it is still not a solution to the problem identified: the network needs alignment to be able to create value in the first place.

Remember the players, their playing pieces, i.e. contributions and motivations, from the first session? They are the value creators, their collective action will result in accumulation of value in the network. So, collectively these players need to agree on the rules of the game (policies) that will be fun to play. If they depend on agents that define tasks for them, we’re just re-labelling gig economy or corporate structures with managers. Giving the agent a different name, might change the mindset of the agent… maybe; offering a different incentive scheme for the action will self-select different type of agents… likely. But it is not a step change.

The agents who only hunt bounties, may risk becoming the uber drivers of web3 - and reaching for these low-hanging “solutions” we may risk that web3 becomes something more akin to what web2.0 players think it is. Or it may become a more burocreatic x chaotic web2.0, transparently accounted for on a distributed ledger.

Hence, we do not yet see applications taking off that need more human coordination other than highly standardized value creation, like financial instruments, which are entirely crypto-native. Shermin’s latest experience with coordination using web2.0 infra plus a decentralized financial/incentive model for the translations and global distribution network for her Token Economy book has interesting insights on coordination overhead of decentralization for highly standardized value creation in non-crypto context of books.

However, if we came up with a way to actually enable a community to align adaptively over the highly dynamic landscape of value creation, we can make use of the web3 technological advances to capture, share and reinvest that value collectively.

The decision making power is one thing, the ability to make good decisions under uncertainty is something entirely else. There are decisions where crowds are wiser (and more efficient) than a single or few expert decision makers - but there are also decisions where crowds are stupid. Which is which is fascinating. In between there is a whole spectrum of potential.

That potential needs a combination new organizational principles.

Which we’ll dig into in the next session: On top of the “fascinating” link above, you may also want to review “Chaordic Organizations”, “Liberating Structures”, and “Radical Agile” - and bring your favorite new organizational principle to discuss!